Yearly gross income calculator

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. The PAYE Calculator will auto calculate your saved Main gross salary.

Year to Date Income.

. Free Income Tax Calculator - Estimate Your Taxes - SmartAsset Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

Personal tax credit for people with low income in the Netherlands - 2477 euros. Try out the take-home calculator choose the 202223 tax year and see how it affects. If the amount shown is different than this amount select No when asked if the amount is correct or seems.

Baca Juga

When filling out your application youll be shown the expected yearly income. It can be any hourly weekly or annual before tax. On the high end of the minimum wage British Columbia pays 1565 an hour 626 a week 2713 a month and 32552 a year.

Sara works an average of. But calculating your weekly take-home. The result is net income.

You can calculate your AGI for the year using the following formula. AGI gross income adjustments to income Gross income the sum of all the money you earn in a year. In Ontario and Alberta thats 15 an hour 600 a week 2600 a.

If your effective income tax rate was 25. Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. The calculator calculates gross annual income by using the first four fields.

145 of your gross income is taken for your Medicare costs taking 580 from you. Get a quick picture of estimated monthly income. The annual income calculation used in this calculator is based on your hourly wage the number of hours that you work per week and the amount of paid time off that you have per year.

How to calculate annual income. Your employer pays FICA tax with is 3060 the addition of both your Social Security costs and your. These figures are exclusive of income tax.

You can change the calculation by saving a new Main income. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. This yearly salary calculator will calculate your.

How Your Paycheck Works. The tax rate on income from savings and. Estimated number of hours worked per week x hourly rate x 52 gross annual income The 52 represents the number of weeks you work throughout the year.

The following table highlights the equivalent biweekly salary for 48-week 50-week 52-week work years. For example if an. Enter the gross hourly earnings into the first field.

Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage Example Lets calculate an example together.

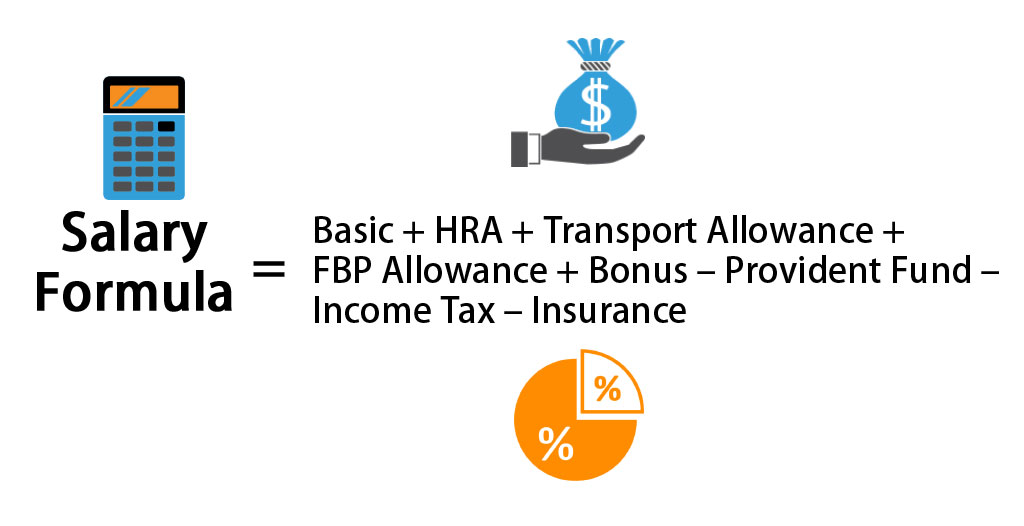

Salary Formula Calculate Salary Calculator Excel Template

Gross Income Formula Step By Step Calculations

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Salary Formula Calculate Salary Calculator Excel Template

4 Ways To Calculate Annual Salary Wikihow

Taxable Income Formula Examples How To Calculate Taxable Income

Income Calculator Sale 54 Off Www Ingeniovirtual Com

Gross Income Formula Step By Step Calculations

Salary Formula Calculate Salary Calculator Excel Template

Monthly Gross Income Calculator Freeandclear

Salary Formula Calculate Salary Calculator Excel Template

Yearly Income Calculator Online 55 Off Www Ingeniovirtual Com

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

How To Calculate Gross Income Per Month